Turnaround tale. How cancer care chain HCG was nurtured to wellness

In February 2021, it hired Raj Gore ? a seasoned healthcare industry professional ? as CEO of the company. Gore has since then focussed on improving efficiency, enhancing profitability by leveraging its scale of operations.

In February 2013, when Hemalatha, a 46-year-old homemaker in rural Belagavi, felt consistent pain in her left breast along with an angry rash on it, she consulted her regular general physician. After some tests, she was diagnosed with localised, non-metastatic breast cancer. Her worried family started to examine hospitals in Mumbai and Bengaluru for further treatment.

However, after consulting friends, extended family, acquaintances and their trusted doctor, they were surprised to note that the necessary treatment was available in neighbouring Hubli, a tier-2 city in Karnataka. A cyberknife non-invasive treatment, which precluded the need for mastectomy, was available at a unit of Healthcare Global Enterprises (HCG).

This is a surprise because even a decade later, today, of the 760 districts in the country, only 175 have comprehensive cancer care centres which means nearly 70 per cent of the districts don't have access to cancer care. An early player in the space of oncology, HCG was set up in 1998 by Dr BS Ajai Kumar, a radiation and medical oncologist who rapidly expanded the chain and even listed the company on the bourses in 2016.

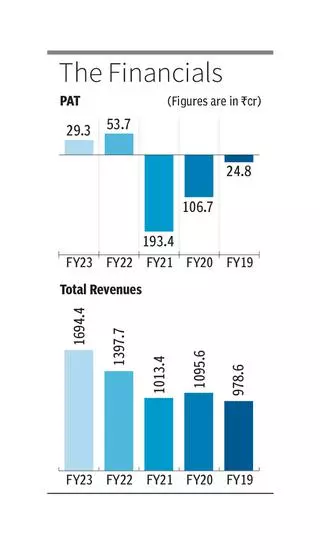

Despite an early mover advantage, HCG underwent severe financial challenges mainly because in speciality healthcare, the fixed costs account for two thirds of expenses. Nearly four years after listing, even as its topline grew to ?700 crore, it made losses of over ?65 crore. The shares of the company were hammered on the exchanges.

From a low of ?70 in April 2020, now, HCG's share prices have more than quadraupled and is currently trading at ?330-350. So what changed in the last three years? CVC Capital, a PE firm, decided to take a majority stake in the company through an open offer in July 2020 and infused professional management, recognising the company's potential and the size of the cancer care opportunity.

In February 2021, it hired Raj Gore ? a seasoned healthcare industry professional ? as CEO of the company. Gore has since then focussed on improving efficiency, enhancing profitability by leveraging its scale of operations. At present, HCG has 24 hospitals across 18 cities in nine States, making it one of the largest cancer care hospital chains in India.

?We are India's largest oncology service provider. What sets us apart is the comprehensive cancer care and diagnosis treatment we offer which includes ? radiation therapy, medical oncology and surgery, making us a one stop healthcare provider for cancer. All the corrective measures taken in the last couple of years have been a game-changer for the company. From posting a loss of ?1.44 crore post minority interest in our first year after going public to posting a profit of ?29.3 crore in FY23, the company has come a long way,? says Gore.

In fact, the company continues to carry its growth momentum as it posted a 47.17 per cent increase in net profits, reaching ?3.65 crore in the first quarter of FY24.

Re-building a brand

As part of the restructuring process, the company discontinued projects that were incompatible with its future direction, divested from non-core areas, including the sale of its 38.5 per cent stake in a biodiagnostic company, Strand Genomics, and implemented an asset light model for expansion, says Gore.

?The last two-and-a-half years have been spent building the brand, building a sales force, and building the network activities, whether it's screening, awareness of continuing medical education (CME) and more, to make sure that we get the footfalls,? noted the CEO.

The results can be clearly seen. In Q1 of 2021, the first quarter after he took over, HCG had revenues of ?193.5 crore compared to the latest reported quarter of Q1 FY24 when it had revenues of ?463.1 crore. More importantly, from making losses of ?39.8 crore in Q1 of FY21 compared to a profit of ?3.65 crore in Q1 FY24, the turnaround has been remarkable.

HCG says it will continue its expansion spree. Currently, it is in the process of constructing two more hospitals ? Whitefield, Bengaluru, which would be operational by Q3 FY25, and Ahmedabad by Q1 FY25, with an overall investment of ?100 crore.

While HCG operates a hospital in Nairobi, Gore emphasises that immediate expansion into the international market is not currently a priority. Going forward, Gore is also confident in sustaining the existing level of growth. ?Since 2015-16, we have always outperformed the market growth. While the market for cancer care is growing at 11-12 per cent, we've been growing by 15-16 per cent.?

Moreover, the ongoing expansion will also see the addition of 300 more beds to its present capacity of nearly 1,850 beds, 20 more operation theatres, and 5-9 linear accelerators, over the next 2-3 years. The chain will also add about 60-80 bedded standalone cancer care centres ? in existing or adjacent markets inorganically, he adds.

ICICI Direct in a recent research report noted that ?HCG with its integrated, one stop solution and focused model is well poised to capture growing potential with pan-India focus on cancer therapy.? Gore for one says he is focussed on making HCG the go to brand for cancer care in the country even as he competes with large multi-speciality hospitals.